[ Online ] 2020-11-30 [ Online ] 2020-11-30 |

|

|

| |

|

|

|

Sponsors lose heart on money doctors, exit from funds

|

|

Although money managers take fees up to 2.5% on different fund sizes, returns for investors are zero or at best 3% |

| |

|

Fund managers otherwise known as money doctors are supposed to make money grow and so investors flock to them. But as one after another mutual fund managers flop in Bangladesh, their sponsors are rather leaving them in a hasty retreat.

Fund management businesses grew manifold over the last decade with plenty of new entrants, mostly sponsored by banks and non-bank financial institutions.

Although money managers take fees up to 2.5% on different fund sizes, returns for investors are zero or at best 3%.

BD Finance, one of the corporate sponsors of Vanguard AML BD Finance Mutual Fund One (VAMLBDMF1), on 18 November announced the sale of more than half of its stake with intent to exit the investment.

BD Finance has an investment of Tk18.5 crore with the fund and got only 3% in return this year, which is mainly a negative return as its financing cost was above 9%. The company got zero return from the fund last year.

Vanguard Asset Management, which manages a total Tk260 crore of funds, is the fund manager of BD Finance sponsored fund.

"We are selling our stake as the fund's performance is not encouraging," said Md Kyser Hamid, managing director of BD Finance.

The main objective of a mutual fund is to give yearly dividends to sponsors but fund managers are not playing their required roles in this regard, he said.

"We are not actually happy as fund managers have failed to optimise returns," he added.

The recent price hike of mutual fund units after a long break provided the opportunity to maximise returns by selling units, he said.

In November, Eastern Bank Limited (EBL) announced plans to sell 20% to 30% of its stakes from its three sponsored mutual funds – EBL First Mutual Fund, EBL NRB Mutual Fund, and First Bangladesh Fixed Income Fund.

Although EBL is one of the best performers in terms of profitability, it got no dividends for the current year from any of its sponsored mutual funds.

The bank got only 3% in dividend last year and before 2019, it got reinvestment units instead of cash dividends, which actually added no value to the bank's earnings.

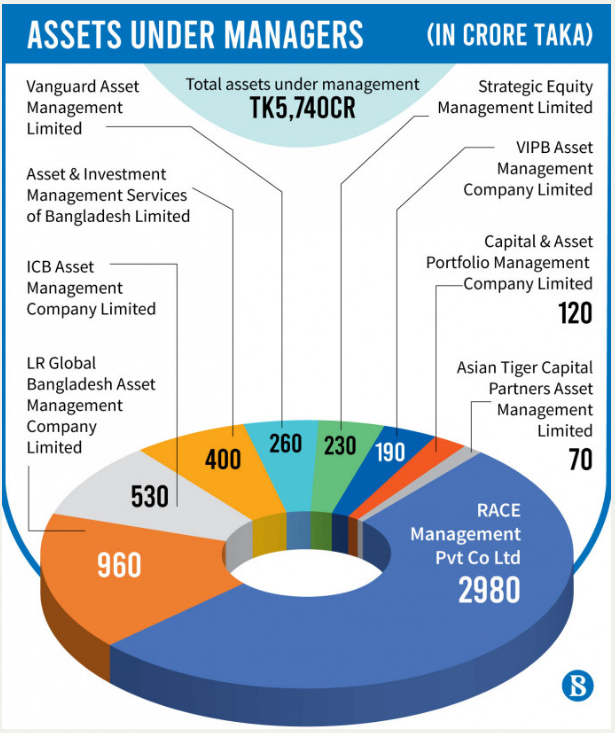

RACE, the largest fund manager in the mutual fund sector having around Tk3,000 crore under its management, is the fund manager of EBL sponsored mutual funds.

When contacted, Ali Reza Iftekhar, managing director of EBL, said the bank is now gaining from the recent price hike of mutual funds as it has not got expected returns from its investment for a long time.

He said the performance of mutual funds was not attractive in the last 10 to 15 years, which eroded investors' confidence.

The bad performance of mutual funds not only prompted banks to make an exit but also discouraged them from going for further investment.

Banks made fresh stock investment amounting to Tk622 crore under the special liquidity support scheme offered in February this year. But not a single penny of the amount went to mutual funds.

Poor fund management and lack of transparency are the reasons for mistrust among sponsors in fund managers, prompting investors to change managers.

For instance, investors of Green Delta Mutual Fund and DBH 1st Mutual Fund changed their asset manager – LR Global Bangladesh Asset Management Company – last year.

The decision came after the investors smelled corruption in the fund investment process of the fund manager.

IDLC Asset Management Ltd has been appointed as the new asset manager for both the funds.

However, investors could not settle the shifting of issue manager even in one year as the existing fund manager is delaying the process, which is ultimately affecting investors' confidence in mutual funds.

The disclosure of Net Asset Value (NAV) of the funds – which is mandatory to be disclosed every week – remained suspended due to a delay in shifting the process keeping investors in the dark about the performance of the two funds.

What triggered recent price hike of mutual fund units

On 27 October, Shibli Rubayat-Ul-Islam, chairman of the Bangladesh Securities and Exchange Commission (BSEC) said listed mutual funds have the capability of paying 10%-18% in dividends to their investors.

After his remark, institutional investors started giving sale declarations in November as unit prices started going upward from October.

The prices of mutual funds gained around 12% in the last two months until last week, according to the Dhaka Stock Exchange (DSE).

However, the chairman's remark has gone completely opposite to the financial conditions of mutual funds.

The BSEC found that some fund managers declared dividends despite counting losses, causing a capital erosion of funds. Others have no capacity to declare dividends as they invested full funds in a portfolio, which ultimately caused them to incur losses.

For example, ICB AMCL Sonali Bank Limited 1st Mutual Fund declared a 6% dividend for the accounting year ending on 30 June 2019.

The fund manager declared the dividend without maintaining the required provision of Tk18 crore against its loss. If the provision was maintained, the fund would count a loss. The fund manager showed its net profit amounting to Tk5.74 crore that year.

As per the mutual fund law, the authorities of any mutual fund have to keep 100% provision against the unrealised loss.

In the same way, ICB AMCL First Agrani Bank Mutual Fund declared a dividend despite having a provision shortfall. The fund had a provision shortfall of Tk13 crore at the year ending June 2019 when its net profit was Tk4.8 crore. The fund declared a 5% cash dividend for that year.

Seeking anonymity, a commissioner at the BSEC told The Business Standard that they found several such cases where mutual funds declared dividends despite suffering losses.

He said this is proof that there is a lack of governance in the fund management.

When a mutual fund is giving dividend despite being in a loss that means it is losing its capital, which ultimately will make the unit holders losers when the fund will be liquidated after maturity.

He said most mutual funds have no capacity to give dividends because of their inefficiency in fund management. A mutual fund is supposed to invest a certain portion in fixed income tools to cover stock market price losses, but they invested mostly in stocks and non-listed securities, he observed.

The BSEC is working on bringing governance in the fund management, he said.

How Bangladesh Bank barred banks from investing in mutual funds

The Bangladesh Bank has differentiated investable and non-investable mutual funds by setting some criteria for evaluating their performance under the liquidity support scheme of Tk200 crore offered for each bank.

Most mutual funds could not conform to those criteria, proving themselves underperformers.

Under the Bangladesh Bank investment criteria, banks can invest in mutual funds which have disbursed cash dividends for three consecutive years.

But only 13 out of 37 closed-end and six out of 58 open-end mutual funds complied with the criteria.

The Bangladesh Bank has basically kept banks away from investing in the existing mutual funds by imposing those conditions and encouraged them to form new mutual funds.

For the formation of new mutual funds, the central bank mandated investment in fixed income securities or fixed deposits for fund managers.

The new mutual funds will have to invest 70% of funds in equity and the rest will go to listed fixed income securities or FDR.

The condition was imposed from the experience of bad performance of the existing mutual funds, said a senior executive of the Bangladesh Bank.

Explaining the issue, he said most existing mutual funds invested all their funds in stocks and incurred huge losses. They did not invest in any fixed-income tools, which could give a minimum of return to the investors at the year-end even after the fall in price indices of the stock market.

Moreover, the central bank observed that some mutual funds invested in non-listed securities and got no returns, causing losses for investors, which ultimately eroded confidence in unit investments.

In this situation, the central bank mandated an investment of 30% fund in fixed income securities so that mutual funds can continue dividends even after incurring losses in portfolio investments, he said.

Size of mutual funds

The market capital of the mutual fund sector stands at Tk4,130 crore. The total fund under management of mutual funds is Tk5,740 crore. RACE holds the highest 52.5% market share of the funds, followed by the LR GLOBAL 16.0%, ICB AMCL 9.3% and AIMS 7.0%. |